As Benjamin Franklin said, “in this world nothing can be said to be certain, except death and taxes.” Most people are familiar with property tax, income tax, and sales tax but did you know that there is a special type of state tax that is paid on production of oil & gas? This tax is called a Severance Tax and it is levied upon non-renewable natural resources that are removed from the earth. This includes resources like oil, natural gas, oil shale, metallic minerals, and coal.

Typically severance tax is paid at the state level and as such, tax rates and calculation method vary. The National Conference of State Legislatures website has a table that lists severance tax rates by state.

How much do the States Collect?

According to the U.S. Census Bureau, states collected over $9.8 Billion in Severance Taxes in 2015. In fact, many oil and gas producing states rely on severance tax revenue to cover a significant portion of their state budget.

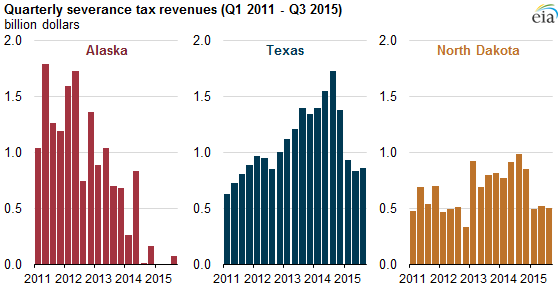

As you can see, Alaska, Texas, and North Dakota all experienced a significant drop in Severance Tax Revenue from 2014 into 2015.

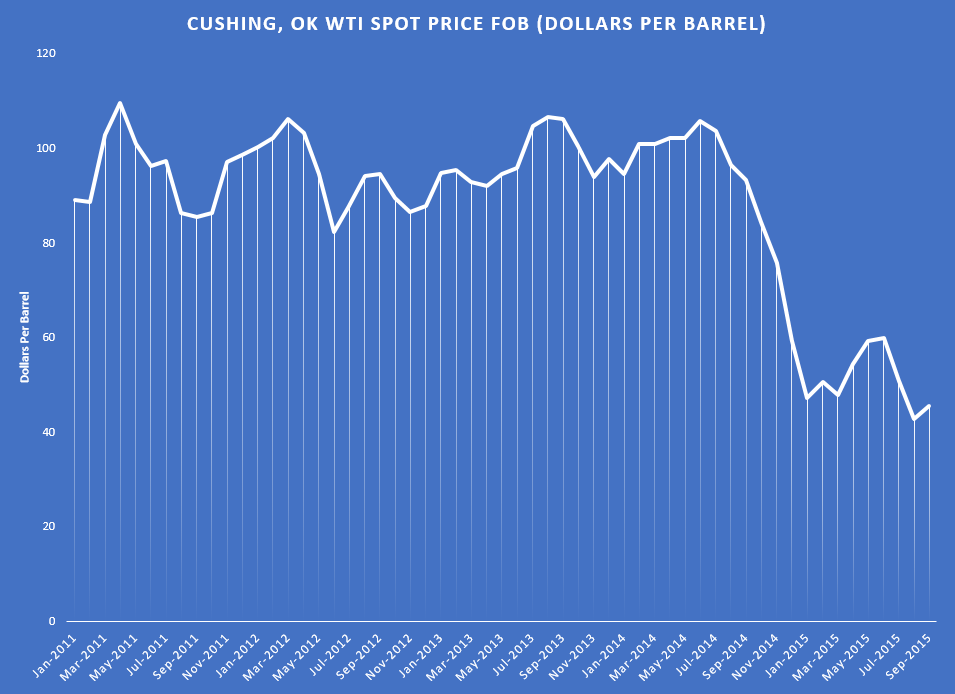

The chart of the West Texas Intermediate (WTI) spot price over the same time period sheds some light on this decrease in severance tax revenue. In fact, the price of oil fell from over $100 per barrel in July 2014 to just under $50 per barrel in January 2015.

So even if you aren’t a royalty owner, you may indirectly benefit from the collection of severance taxes. This is because many states fund various programs and services as a result of this revenue. As you can see, the revenue from this tax can be hard for states to forecast since it is so closely tied to the price of oil & gas.

Who Has to Pay Severance Tax?

If you are a producer or own a working interest, a royalty interest or any other interest from any oil and gas produced, you likely must pay severance tax to the respective state. Severance tax might be due even if you do not realize a net profit on your investment.

Do You Always Have to Pay?

Some states offer rebates or credits for certain types of wells or under certain circumstances (such as during low oil or gas prices). The types of wells that may be eligible for a reduction in severance tax includes marginal producers (e.g. “Stripper wells”), wells in Enhanced Oil Recovery (EOR) fields, or new wells. This allows producers to delay plugging and abandoning marginal wells or to help encourage investment through drilling and completing new wells. Check your state oil and gas commission website for more information.

Ok, so I need to pay severance tax on royalties that I received for the production of oil and gas, but how do I pay it?

If you are a royalty owner, the good news (or bad news, depending on how you look at it) is that severance tax is typically paid automatically by the operator or oil or gas marketer. Your share of the tax is deducted from the gross revenue before you are paid.

If you take a closer look at your check stub, you should see a tax column and a line item that shows the severance tax deduction. Here’s a sample check stub that shows the severance tax deduction in action.

Did you Know About the Colorado Ad Valorem Tax Credit?

If you pay severance tax in Colorado, you may be able to offset some of your tax liability through a credit on the ad valorem tax paid on production of oil & gas. This property tax credit against your Colorado state severance tax liability is calculated based on “87.5% of all property taxes paid except those imposed on equipment and facilities used for production, transportation, and storage.” (Source: Colorado Legislative Council Staff Website).

The reason for this is because oil & gas production in Colorado is subject to local ad valorem tax at an assessment of 87.5% of market value (which is much higher than the local tax rates in other states).

Conclusion

So whether we like it or not, Severance Tax exists and it is levied upon non-renewable natural resources such as oil & gas that are extracted from the earth. As a mineral rights owner, I like severance tax more than most other forms of tax. My justification is that if I’m paying severance tax that means I’m receiving royalty income and the full value of my minerals is finally being realized.

This article is only meant to provide an awareness of Severance Tax. As with any tax matters, you should consult with a qualified tax expert for advice.

If you found this article helpful, please follow us on Twitter and Facebook to ensure you are updated when our next article is published.