Calculating your revenue interest in a well is straightforward once you have a few key pieces of information. Armed with this information, you can calculate what your expected Net Revenue Interest (NRI) should be for any existing or future wells drilled on your Mineral Rights in just a few minutes. That way, you can verify that any Division Orders you receive for these wells are correct and that you are getting paid what you deserve

What is a net revenue interest?

Net Revenue Interest or NRI refers to the share of production that a party owns in an oil & gas unit (e.g. well, lease, drilling spacing unit). For the purposes of this article, we will be focusing on the landowner’s (royalty owner’s) interest but keep in mind that the NRI for each unit must total 100% and is made up of both the royalty owners and working interest owners portions.

Where to begin?

What you will need to get started is an understanding of how many Net Mineral Acres (NMA) you own, the size of the Drilling Spacing Unit (DSU) where the well is located, and the agreed royalty rate per your oil and gas lease. Usually, these first 3 items are easy to find.

Additionally, you will need to know if your royalty is burdened by a Non-Producing Royalty Interest (NPRI). Identifying if there is a NPRI usually requires performing a title search to understand the history and if anything was carved out. For the purposes of this article, we will assume that the royalty is not burdened by a NPRI.

What is a “NMA”?

The term NMA refers to Net Mineral Acres, or the net acreage of mineral rights that are owned. To figure this out, you must first start by understanding the Legal Description. If you know the decimal interest in your mineral tract and you have the legal description, you can calculate the Net Acres owned.

Here’s an Example:

Let’s say that you own mineral rights in all of Section 17, Township 139N, Range 101W in Billings County, North Dakota. The gross acres for this section is 640 acres, and you own 1/36 interest in this tract as of today’s date. Your decimal interest in this tract is 0.027778 so:

Net Mineral Acres = 640 Acres x 0.027778 = 17.78 net acres.

If you don’t know the decimal interest or fraction of ownership, this can be determined by performing a Title Search on the property. This can be obtained in many cases where there is a clear chain of title for only a few hundred dollars. In a title search, a landman or lawyer will search the county records and note each transfer of ownership back in time. As part of the report you will get a report of the decimal interest owned and an estimation of the net acres. Oh, and remember the NPRI we mentioned at the start? You will also get a listing of any NPRI’s that might have been carved out of the mineral interest.

Ok, so what is my Royalty Rate?

The next item you will need to know is the Royalty Rate for the tract in question. If you were the one that leased this tract, then you can find this information on your Oil and Gas Lease. On the first page look for a statement like:

“The lessee shall deliver to the credit of the lessor as royalty, free of cost, into the tanks or in the pipe line on the leased premises to which lessee may connect its wells the equal fifteen-percent (15%) part of all oil produced and saved from the leased premises.”

In this case, the Royalty Rate is 15%. There will also be a similar statement referring to payment for gas sold. This is your Royalty Rate and you will need it to calculate the Net Revenue Interest. If you don’t have the lease, you can perform a search in your county clerk & recorder’s office or hire the services of landman to do it for you.

Now, How big is my DSU you might ask?

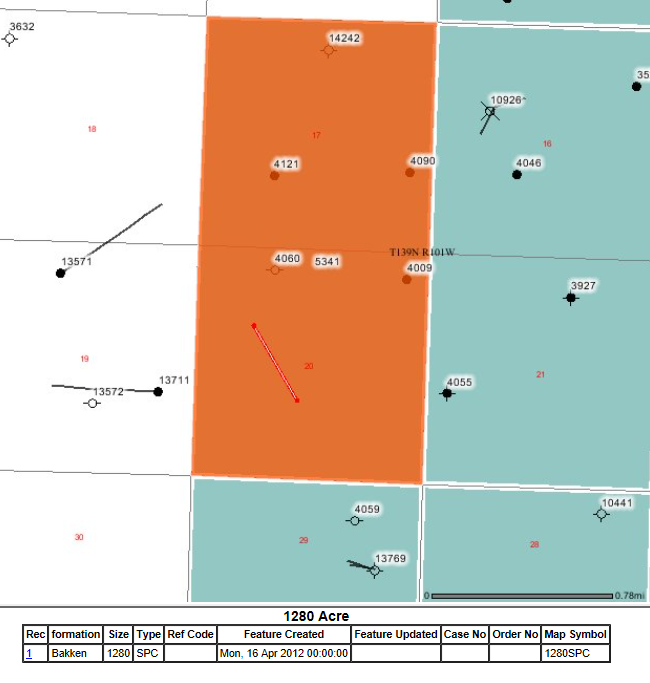

The final item you need to know is the size of the Drilling / Spacing Unit (DSU) where the well is. Fortunately, this information is usually available on your State’s Oil and Gas Commission Website. In the case of our example, we went to the North Dakota Industrial Commission, Department of Mineral Resources, Oil and Gas Division website for this information. The GIS Map Server shows the Drilling / Spacing Units in a layer that you can turn on. Let’s assume for the purposes of this example that I just found out that a Horizontal Bakken well is permitted on my minerals. Here I’ve selected the DSU for the Bakken Formation which covers 1280 Acres and includes Sections 17 & 20, Township 139N, Range 101W:

Let’s do some math!

Ok so maybe you didn’t like math in school. Have no fear, all we have left is a simple multiplication problem so go get your calculator. What are you waiting for, go get it now! Here’s how to calculate the Net Revenue Interest:

Net Revenue Interest = Net Mineral Acres / Drilling Spacing Unit Acres * Royalty Rate

Continuing our example, here’s what we know:

Net Mineral Acres = 17.78 Acres

DSU Size = 1280 Acres

Royalty Rate = 15%

So, our NRI = 17.78 / 1280 * 0.15 = 0.0020835

This means we will receive 0.20835% of any oil or gas sold on this new well. Before you start shedding a tear and say to your self “there goes my hopes of becoming an oil baron”, let’s put it into real dollar terms.

calculating your average oil royalty payment

Now that you know your NRI, you can do a few minutes of research to estimate how much your oil royalty check should be. You can follow these same steps to estimate the amount of your gas royalty payment (just substitute the estimated gas production in mcf and the price of gas in $/mcf for your area).

Looking at nearby Horizontal Bakken wells drilled on 1280 Ac spacing, They appear to average around 10,000 bbls of oil over the first 3 months of production. (If you are wondering where to go to get this info, check out your State’s Oil and Gas Commission Website. Many states offer this information for free. In the case of our North Dakota Example, you have to pay for at least a “Basic Subscription” which is $50/year at the time this article was published).

So assuming our new well averages this, and the price of Bakken crude is $40/bbl, here’s what we might expect in the royalty check for this one well for these months:

Gross Owner Interest (before tax) = Gross Volume x Gross Price x NRI or:

10,000 bbls x $40/bbl x 0.0020835 = $833.40

And this is just for the oil produced (you can calculate gas revenue the same way). Not too bad for income you likely weren’t expecting to receive! To be able to estimate how much you will receive based on future production forecasts becomes more of an engineering exercise. But now you see that you don’t need to worry about higher math in order to estimate your royalty payment.

Now, you can calculate your Net Revenue Interest

So, you can use this information to estimate how much your royalty check should be and to make sure that the NRI shown on any Division Orders you receive from the operator are correct. Now, you can make sure you are getting paid the royalties you deserve!

This information is provided for educational purposes only so please remember that your mileage may vary. If your case is complicated, you may need some outside help from a qualified landman or engineer to locate the required information or to help with these calculations. The oil and gas business comes with risks so even though a great well was drilled in the adjacent section, it doesn’t mean that the same thing will happen where you own minerals. Production could be higher or lower, or non-existent when compared to offset wells.

If you have any questions about how to do this for your minerals, please contact us today for a free consultation and we’d be happy to help!